Digital Wallets and Migration Policy: A Critical Intersection

With contributions from Aaron Martin (Humanitarian Action Programme, European Centre on Privacy and Cybersecurity, Maastricht University), Keren Weitzberg (Institute of Advanced Studies, University College London), Emrys Schoemaker (Department of International Development, London School of Economics)

Editor's Note: The paper is part of The Dialogue on Tech and Migration, DoT.Mig. series, see The EU AI Act Proposal: Europe’s Opportunity to Safeguard the Rights of People on the Move and Exploring the Potential of Data Stewardship in the Migration Space to read the related pieces.

Key Takeaways

Expand AllDefining Digital Wallet

A digital wallet is an electronic method of storing, managing, and exchanging money and/ or identity credentials, often through the use of mobile phones.

Digital Wallets are Proliferating in Humanitarian and Cross-Border Contexts

A variety of digital wallets are proliferating in humanitarian and cross-border contexts, including, but not limited to, blockchain-based schemes.

Financial Inclusion and Identity Recognition Across Borders

Digital wallets are designed to empower users with a secure, persistent, and selfmanaged means of financial inclusion and identity recognition across borders. International institutions and governments may encourage the adoption of common technical specifications, which promises to make fragmented data systems more harmonized and interoperable.

The Risks of Migration Management

However, the risks of migration management stakeholders adopting digital wallet models include:

- Emerging and/or untested infrastructure and standards for cross-border digital wallet schemes;

- Digital wallet innovation through legitimate institutions and motives, as well as bad actors and cryptocurrency scams designed to mislead;

- Inability to assume that all digital wallets, including those based on blockchain technology, are privacy enhancing or decentralized; and

- Insufficient safeguards given that digital wallets require people to bear greater responsibility for holding and managing personal data and money.

Urgent Need for More Evidence, Research, and Investigation of Digital Wallets

In migration contexts, there is an urgent need for more evidence, research, and investigation of digital wallets in practice as use cases emerge.

Introduction

A range of international bodies have recently begun experimenting with digital wallets. Digital wallets take many forms but are typically mobile phone-based systems that enable people to make electronic transactions and/or share identity credentials. In cross-border and migration contexts, digital wallets promise to have wide ranging implications for global governance, especially in identity management and finance. Aid organizations, governments, technology companies, and other interested parties are testing digital wallet projects that either target, or incidentally affect, migrants and refugees along with mainstream citizens.

A pertinent example is Ukraine’s Diia wallet. Precipitated by the COVID-19 pandemic and the reliance on digital systems for governance, the Ukrainian government launched the Diia wallet in 2020.1 Diia provides Ukrainians with a centralized, digital platform for storing, managing, and sharing official credentials such as vaccination records, insurance documents, passports, ID cards, and licenses.2 Through the Diia mobile application, Ukrainian people can engage with the government to update residence or driving license information, pay taxes, or access benefits, among other uses.

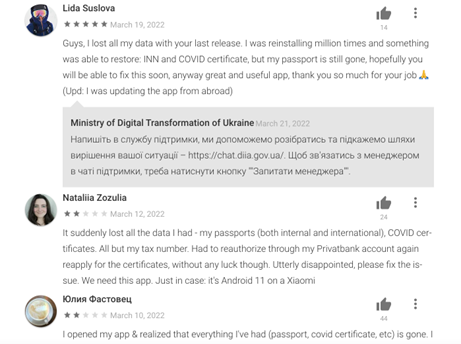

In early 2022, Russia's war on Ukraine prompted the mass displacement of Ukrainian refugees. Key government infrastructures have been and continue to be targeted, compromised, and/or destroyed by Russian forces. Some Ukrainians have lost access to their devices, network connections, and digital ID documents in the Diia wallet (see Figure 1). However, others are using the wallet to access vital assistance. Internally displaced people are receiving monthly aid to cover living expenses; refugees are using Diia to donate to the army, report on enemy troops, and access TV and radio.3 The Diia wallet is a key example of a mainstream digital wallet system being stress tested in circumstances of political conflict and displacement. It illustrates the urgent need to investigate the implications of national digital wallet systems for governments and people in crisis:

- Does the digital wallet infrastructure support the secure continuation of government services and assistance?

- Do digital wallets boost the resilience of internally displaced people and refugees rebuilding their lives across borders, including marginalized groups?

- What are the risks of a digital wallet system, and how are they playing out in conditions of mass displacement?

Meanwhile, the Ukrainian government has enlisted another kind of digital wallet—a cryptocurrency wallet—to collect international donations supporting the war effort. Ukraine has already used the equivalent of US$15 million in cryptocurrency to fund military supplies.4 This case leads us to ask:

- What do we know about the politics, security, and stability of digital wallet models for humanitarian aid?

- As opposed to traditional bureaucracies, how do digital wallets fare when conventional state institutions break down and the movement and safety of populations becomes a central concern?

Figure 1: Screenshot taken by Margie Cheesman on April 4, 2022 from the Diia wallet page on Google Play, the site where the wallet can be downloaded.

Ukraine’s Diia wallet and cryptocurrency fund illustrate several wider developments:

- Firstly, the term digital wallet previously referred to payment technologies, but now its use increasingly extends beyond finance and into the domain of identification.

- Secondly, digital wallet concepts and projects are closely related to innovations in decentralized technologies, particularly cryptocurrency and its enabling infrastructure, blockchain.

This research brief unpacks key developments in technology, finance, and identity to generate informed, critical discussion about digital wallets for the migration sector. We discuss the latest and most prominent examples of digital wallet case studies relevant to migration policy stakeholders.

1. What are digital wallets?

There is currently a lack of consensus and clarity around the term digital wallet. It is broadly used to refer to electronic devices, software programs, mobile money functionalities, payment methods, identity management software, and more. For example, some suggest digital wallets are payment systems like PayPal, while others suggest that they are end-user tools that slot into those systems. As more digital wallet applications and use cases emerge, we need in-depth studies to strengthen our knowledge and definitions. For the purposes of this brief, our working definition is:

Digital wallets are technological systems that store (a) information and (b) value, enabling users to track and execute transactions. They are used to hold and exchange currency, tokens, and coupons, along with passwords, identity information, and credentials.

2. Why are digital wallets gaining importance in migration contexts?

Digital wallet projects are changing how information and money flow across borders. They are being tested internationally by institutions like the International Organization for Migration (IOM) and other UN agencies, global governments, and the European Union, as well as technology companies and start-ups. Today, digital wallets are widely seen as a solution to the constraints of traditional finance and identity systems, including issues of surveillance, trust, and interoperability. They propose to empower individuals with the ability to manage their own money and data flows with greater privacy, security, and consent.

Wallets promise migrants a safe, organized, and reliable way of storing and using their identity credentials, savings accounts, and other resources across borders. This is currently a challenge, especially in contexts of forced migration when people’s access to essential (and often paper-based) personal documents and finances, issued by a range of providers, becomes compromised. Wallets give migrants a way of keeping different resources in one place, while holding them independently—for example, data about the resources in the wallet is not shared between the different providers. At the same time, as a new way of organizing disparate sources of information and money, digital wallets promise to harmonize the fragmented data systems institutions use to manage populations.

Digital wallets are now central to future designs for the governance of mobile and pandemic-affected societies and are regularly connected to hot topics like Web3, decentralized finance (DeFi), artificial intelligence, and wearables.5 Notable examples in everyday life and news have recently driven popular interest. These include Apple’s announcement that the Apple Wallet will hold driving licenses in addition to bank cards; debates around how people should manage their COVID-19 vaccine credentials; and scandals around Facebook (now Meta)’s ambitious proposal for an expansive wallet and currency project, Libra (later rebranded as Diem).6 But digital wallets are not exactly new, nor are they simply technologies found in the Global North. For example, the impact of digital wallet innovations on cross border finances, migration, and migration policy in the South can be observed through mPesa: 96% of Kenyan households use the electronic wallet mPesa to pay for everything from coffee to taxes to remittances across borders.7

3. How are digital wallets related to other innovations like mobile money and blockchain?

Mobile money wallets like mPesa in Kenya or Smart Money in the Philippines allow people to manage finances using a basic feature phone (not connected to the internet) or smartphone. Mobile money originated as a way of storing and exchanging airtime credit. In the Global South, it provided users who lack access to a reliable range of financial services and the required identity documents a crucial means to save and transact.

Digital wallet as an umbrella term includes mobile money initiatives, but it also includes new kinds of identity management systems and personal, tech-based money management platforms—for example, those based on blockchain.

Digital wallets are closely connected with the emergence of blockchain. Blockchain technology was invented to support the cryptocurrency Bitcoin, which was designed as a non-state alternative to unreliable financial institutions after the banking crisis in 2007 and 2008. Put simply, blockchains are decentralized database systems. They are now used well beyond cryptocurrency. For example, the self-sovereign identity (SSI) movement proposes that blockchain will help orient identity management away from corporate intermediaries and instead empower individuals—especially migrants and refugees who lack the support of political and financial institutions and bureaucratic systems—to own and manage their own personal information.

- It is important to note that digital wallets do not require the use of blockchain. They are not necessarily decentralized. They follow a variety of models, standards, and institutional and infrastructural arrangements, including but not limited to SSI.

Among digital wallet projects that use blockchain, some propose a radical alternative to traditional currencies and identity management systems, but some do not—indeed, some of the most significant wallet initiatives are government led.8

4. What are the key case studies?

4.1. Digital wallets for financial inclusion across borders

Proponents of digital wallets suggest they extend access to credit services and local market integration for migrants. However, in many cases this is unproven. Box 1 describes notable blockchain-based experiments to illustrate the broad range of agendas and implications:

- At one end of the spectrum there are schemes like UNICEF’s Leaf project which use blockchain to equip tech savvy, low-income migrant populations with fee-saving, independently managed financial tools.

- At the other, experimental ventures like Worldcoin offer people untested and meaningless cryptocurrencies. Under the banner of wealth redistribution and financial inclusion for marginalized groups like refugees, such schemes pose concerns for privacy and data protection. Bugs in their implementation may have detrimental effects to people’s socio-economic lives.

- 1https://www.gearrice.com/update/in-ukraine-an-air-of-social-credit-with-the-diia-application/

- 2https://play.google.com/store/apps/details?id=ua.gov.diia.app

- 3https://reliefweb.int/report/ukraine/new-services-idps-presented-diia-summit-kyiv-enuk and https://www.biometricupdate.com/202204/ukraine-and-estonia-show-government-digital-id-leadership.

- 4https://time.com/6155209/ukraine-crypto/

- 5https://www.biometricupdate.com/202202/cb-insights-projects-digital-wallets-will-follow-trajectory-of-super-apps

- 6https://www.ft.com/content/a88fb591-72d5-4b6b-bb5d-223adfb893f3

- 7https://www.vox.com/future-perfect/21420357/kenya-mobile-banking-unbanked-cellphone-money

- 8https://www.thalesgroup.com/en/markets/digital-identity-and-security/government/documents/what-is-EU-ID-wallet

UNICEF’s Leaf Wallet

In 2019, UNICEF launched the Leaf project for refugees and cross-border traders in East Africa. By the end of 2022, the project anticipates reaching 23,847 people. Leaf is a blockchain-based digital wallet. Leaf users can store money in multiple currencies (currently RWF, KES, and UGX), pay for goods and services in their selected currency, and make exchanges with other Leaf users within the wallet. Bypassing traditional money transfer systems like Western Union or MoneyGram, the blockchain infrastructure allows Leaf to circumvent the fees associated with cross-border finance, which range from 20% to 30%. Settlement costs are almost zero with Leaf, allowing people to avoid extortionate costs. The wallet does not require smartphone or internet connection; it can also be used via feature phone and USSD short codes. In addition, the wallet is integrated with the mobile money ecosystem in East Africa, as users can request funds from mobile money numbers across borders. Twenty percent of Leaf users are under 21: the project targets young, technologically savvy individuals as a way of supporting their financial independence, responsibility, and skills.

The Worldcoin Wallet

Unlike UNICEF’s Leaf wallet, where users avoid market volatility by storing money as tokenized versions of established currencies, other blockchain-based digital wallets projects use their own cryptocurrency schemes. A notable example is Worldcoin. The Worldcoin wallet has been tested in 24 countries, including Indonesia, Chile, Sudan, and Kenya. In March 2022, 450,000 individuals had been onboarded as users. Worldcoin promotes a project of borderless international wealth distribution. The Worldcoin company funds local subcontractors to identify and onboard low-income customers. When people sign up and register for a Wordcoin wallet—available on Google Play and the Apple Store—they receive a social assistance giveaway of WLD (the project’s cryptocurrency). The Worldcoin company suggests WLD is a neutral, borderless, and collectively owned global currency. WLD is not pegged to a stable currency such as the US dollar. In fact, this cryptocurrency is not yet launched, and the company has admitted they do not know what its value would be in established financial markets. An investigation by MIT Technology Review journalists[9] in early 2022 revealed that Worldcoin users were not yet able to trade WLD from their wallets, and that when the company transitioned from a web-based to mobile app-based wallet scheme, many users lost their accounts and WLD tokens. Many customers had to be supported with basic mobile training to download the wallet in the first place.

Box 1: Digital wallet case studies designed to improve financial inclusion across borders.

[9] https://www.technologyreview.com/2022/04/06/1048981/worldcoin-cryptocurrency-biometrics-web3/.

Therefore, migration policy stakeholders must critically evaluate the diverse actors and agendas in the digital wallet space. It is also important to note examples like IOM Mexico’s electronic wallets for Venezuelan refugees10 and the World Food Programme (WFP)’s digital wallets for Syrian refugees in Jordan.11 While Worldcoin smartphone wallet adoption involved a steep learning curve for its target users, these projects involve prepaid cards and paper receipts, not mobile phones, and the organisations control refugees’ accounts.

- In aid and migration contexts, many digital wallets are currently less high tech, user-managed, and wallet-like than they might appear. As the IOM and WFP projects exemplify, refugees are interacting with wallet systems in basic, low-tech ways, which puts in question how meaningful or empowering this concept currently is for these groups.

4.2. Digital wallets for cross-border recognition

Access to financial services depends on access to formal state or supra-state sanctioned identification. Digital wallet schemes are influencing how nation-states and international organizations approach identity management across borders. The most notable and developed example is the European Union’s new digital identity wallet (EUDI), which will be made available to all EU citizens by September 2023.12The consequences for third country nationals residing in the EU are emergent. This scheme represents a new way for public and private entities to coordinate and recognize diverse types of digital identities used within a multi-country environment.

- Wallets promise to enhance the efficiency and harmonization of identity authentication and, therefore, business across borders, for example, within the EU’s single market.

The European Union’s Digital Identity Wallet

In 2021, the European Union launched the Digital Identity Wallet Consortium comprising representatives from EU member states.[13] Member states will implement the European Digital Identity (EUDI) wallet based on common technical standards with the aim of cross border recognition.[14] The consortium is developing a range of use cases for the EUDI wallet, including educational and professional qualifications, mobile driving license and travel credentials, and payments. The wallet will be made accessible to EU citizens in mobile and desktop environments. It aims to connect verified citizens with reputable and trustworthy services in government but also the private sector (banks, gyms, telecoms, airlines). This is expected to drive adoption compared with the EU’s original, public-sector focused eIDAS scheme.[15]

The wallet is explicitly designed not to collect data about citizens’ use of their wallet, or any personal information that is not strictly necessary for the wallet service provision. Service providers can verify the validity of information without seeing the actual information; organizations that issue people with credentials cannot trace what they do with those credentials. The promise of the EU digital wallet is therefore enhancing interoperability and cross-border recognition, while protecting against tracking and surveillance.

Nevertheless, there has been controversy about the EU’s position on digital wallets in the Web3 community. While the EUDI promotes privacy, proponents of an open, blockchain-based identity ecosystem stand against the EU’s commitment to Know Your Customer (KYC), Anti-Money Laundering (AML), and consumer protection regulations, which would limit possibilities for pseudonymous, self-managed identities.[16]

[13] https://eudiwalletconsortium.org/.

[14] https://forum.eid.as/t/european-digital-identity-architecture-and-reference-framework/216.

[15] https://www.evernym.com/blog/eu-digital-identity/.

[16] https://twitter.com/silkenoa/status/1509124788815601669.

The Worldcoin Wallet’s Digital Identity System

Many blockchain proponents are developing radical alternatives to formal identification systems that circumvent regulations. The aforementioned Worldcoin project seeks to become the main system of international recognition, the universal identity authentication mechanism for a future decentralized

digital society—Web3. Registering for a Worldcoin wallet involves the collection of people’s biometrics as well as their email address and phone number. By March 2022, Worldcoin had captured high-resolution images of 450,000 eyes, faces, and bodies, chiefly of people in the Global South.[17] The company reports that they do not store biometric data, only a cryptographic hash of the biometric data. However, Edward Snowden has raised concern that the hashes of the scans could still be used to track people via future scans.[18]

[17] https://www.technologyreview.com/2022/04/06/1048981/worldcoin-cryptocurrency-biometrics-web3/.

[18] https://mobile.twitter.com/Snowden/status/1451990496537088000.

Box 2: Digital wallet case studies in the field of identity management, specifically for cross border recognition.

The EUDI scheme will follow GDPR and is promoted as enhancing privacy and security for EU citizens as they use their wallet across European borders. A key feature of the wallet is selective disclosure for users. However, other digital wallet experiments involve invasive data harvesting practices. Rather than following data minimization principles, blockchain-based biometric systems like Worldcoin are already of concern as international surveillance tools. Overall, digital wallets propose a range of possibilities for identity management across borders. Crucially,

- It is a myth that blockchain-based systems are wholly privacy preserving.

- Digital wallet schemes do not always allow users to selectively disclose and minimize sensitive data sharing.

5. What are the concerns and risks of adopting digital wallets in the migration sector?

When mapping concerns, we must ask a key question: who benefits from digital wallet adoption in migration contexts? Wallet experiments beckon new kinds of technology companies and experts who profit from their foothold in migration management infrastructure. What are the pros and cons of working with blockchain providers as opposed to more traditional technology experts? Does reliance on niche expertise and maintenance capacities lead to vendor lock-in? Ultimately, digital wallets may introduce few benefits for marginalized groups, especially if implemented in a way that unifies identity records into one centralized profile, therefore enhancing the tracking and policing of migrants and refugees. The Global Compact on Refugees encourages socio-economic inclusion. But in the absence of substantive policy and structural shifts, digital wallets may not solve the segregation of refugees from mainstream financial instruments, markets, and identification systems.

Little research exists about digital wallets. In migration contexts, wallet schemes—especially those involving blockchain—are unproven and diverse, deploying a variety of models and logics.19 We need in-depth studies to map success cases as well as failures. We also need qualitative research on refugee, migrant, and other users’ experiences with digital wallets, along with inquiry into security, regulatory, and ethical concerns:

User experience:

It is vital that we understand if and how wallets can be made useful, accessible, and safe for marginalised groups. This includes the issue of infrastructure and literacy requirements, which in many cases may be too high. Detailed research must be undertaken on how migrants and refugees use the technology in practice as opposed to the design and intended use. Wallets will have unintended consequences, and we must examine how migrants and refugees work around design flaws such as when mobile-based digital wallets contain bugs or drain battery life. Another key concern is the implications of user-held mobile wallets as opposed to wallet systems where institutions retain control on migrants’ behalf. User-held wallets may shift accountability onto people to be their own personal data and finance custodians without sufficient safeguards or support. If revoked from or locked out of their wallet by public or even private organizations, the implications to migrants and refugees will be significant.

Storage and security:

When someone gathers credentials in their wallet, the question of where the information will be stored is unresolved. The implications for security and accountability if stored remotely as opposed to on a personal device are very different. For example, cloud storage may be more susceptible to hacking. Basing a digital wallet scheme on blockchain infrastructure involves migrant and refugee users and/or organisations managing cryptographic keys. It may be best for private keys to be stored in a safe hardware component. But without necessary safeguards, it would be risky putting the onus on individuals to safeguard such vital information.

Regulatory concerns:

We need to understand how legal and regulatory frameworks facilitate or impede the use of digital wallets in migration contexts. For example, KYC/CDD and SIM registration requirements usually create barriers for stateless people, people with limited identity credentials, and other crisis-affected people. Mobile-based applications harvest data about people’s transactions, call records, and locations. It is essential that wallets follow strong data protection and privacy standards and ensure identity credentials—especially of persecuted groups—are not traceable. The migration sector needs to ensure that wallet schemes do not evolve into ‘super apps’ whereby a single provider gains monopoly over services and identity authentication in a wallet20 Ideally, wallets will allow refugees and migrants to use multiple digital identities, which is safer and more private than a singular, unitary system. Considerations around financial, banking, and tax regulation will also be relevant. In aid, institutions must consider whether wallets need to be capped in terms of how much users can spend or receive based on donor requirements. The implications of blockchain-based digital wallet systems for data protection regulation in the EU (General Data Protection Regulation, GDPR) are still emerging.21

Wallet schemes will inevitably be used to include and exclude people in order to control, jeopardize, and empower them at the intersection of surveillance and recognition.22 Ukraine’s Diia represents an urgent example. If refugees are relying on the wallet for access to identification and government services, is it reliable and how can their credentials be recovered if the system is compromised? As the multi-country EU identity wallet test pilots launch, evidence must be collected about the design, implications, and effects in cross-border settings. Now, as digital wallets proliferate in migration contexts, these questions and concerns must be addressed through careful policymaking, regulation, and research.

The views expressed in this publication are the views of the authors alone and do not necessarily reflect those of the partner institutions.

- 19 See https://www.tandfonline.com/doi/full/10.1080/14650045.2020.1823836 and https://www.academia.edu/74292400/Blockchain_Sovereignty_and_Humanitarian_Payments

- 20David G.W. Birch, “What Exactly is a Smart Wallet?”https://chyp.com/2022/04/26/what-exactly-is-a-smart-wallet/

- 21https://cyber.harvard.edu/story/2019-09/forget-erasure-why-blockchain-really-incompatible-gdpr

- 22 https://journals.sagepub.com/doi/10.1177/20539517211006744

Glossary

Expand AllAML

Anti-Money Laundering regulation

Blockchain

A family of decentralized database systems most famous for underpinning cryptocurrencies such as Bitcoin

Credential

The means of proving your identity in a digital environment, for example, a username or machine-readable document like an ID card

Cryptocurrency

Alternative, electronic forms of currency where transactions are made and recorded using blockchain rather than centralized authorities

Decentralized Finance

Blockchain-based financial infrastructure which circumvents traditional intermediaries such as banks

Digital Wallet

Technological systems that store (a) information and (b) value, enabling users to track and execute transactions. They are used to hold and exchange currency, tokens, and coupons, but also passwords, identity information, and credentials

Digital Identity

How people are represented and represent themselves in the digital age, for example, through official forms of foundational identification issued by governments, through identities issued by public or private sector service providers, or through the de facto identities individuals accumulate online (social media, credit and mobile records).

eIDAS

The system of Electronic Identification and Trust Services within the EU under European regulation

Feature Phone

Rudimentary mobile phones that do not facilitate access to web applications

Keys

Public and private keys are strings of numbers that are used to encrypt and decrypt data

KYC

Know Your Customer regulation

Mobile Money

Platforms that allow users to store and exchange value electronically using their mobile phones

Self-Sovereign Identity

Decentralized digital identity schemes that claim to give individuals control and ownership of their identity information, and usually deploy blockchain.

SIM

Subscriber Identity Module card issued to every mobile phone user that stores information, for example, about the network and mobile number

Tokenization

Making a representation (token) of physical or digital assets which have a unique code and can be stored and exchanged with blockchain

Web3

Web3 proponents promote a blockchain-based future of digital society in which big tech platforms and centralized institutions relinquish authority and profits

About DoT.Mig

The DoT.Mig In Brief paper series is part of the The Dialogue on Tech and Migration, DoT.Mig.

DoT.Mig provides a learning platform to connect the dots between digital technologies and their use and impact on migration policy, as well as connecting relevant stakeholders. The DoT.Mig In Brief paper series highlights debates and concepts relevant to navigate the emerging field of Tech and Migration.

DoT.Mig is a forum by the Migration Strategy Group on International Cooperation and Development (MSG). The MSG is an initiative by the German Marshall Fund of the United States, the Bertelsmann Foundation, and the Robert Bosch Stiftung.

The views expressed in this publication are the views of the authors alone and do not necessarily reflect those of the partner institutions.