How Its War on Ukraine Killed Russia’s Hydrogen Ambitions

Summary

Hydrogen looks like the fuel that can facilitate global decarbonization because it can be used in diverse applications—such as heat and power generation, transport, and manufacturing—without any carbon emissions. But, while many countries (including in Europe) view renewables-based, zero-carbon hydrogen as the ultimate goal in transitioning to a hydrogen economy, today most hydrogen is produced from natural gas. Thus, it is unlikely that the hydrogen transition will happen without relying on this fossil fuel.

Russia is the country with the world’s largest natural gas deposits, and it has been exploring ways to adjust its energy sector to the needs of the emerging global hydrogen one. In 2021, it announced the goal of capturing up to 20 percent of the world’s hydrogen market by 2030. This came after all the major importers of Russia’s energy products had developed their hydrogen strategies, and its key energy companies started to explore new opportunities. Having signed memoranda of understanding with some of the world’s major energy companies to jointly develop Russia’s hydrogen export potential, they focused on Europe as the key destination. Some of Asia’s hydrogen pioneers and most promising future importers, such as Japan and South Korea, were also included among Russia’s potential partners.

These steps could have resulted in long-lasting and fruitful collaborations generating large profits for Russia, but its ambitions have been jeopardized by its invasion of Ukraine in February 2022. This has led to Russia losing key political and economic partners in Europe and also in Asia, which—in combination with being the target the toughest sanctions in its history—is likely to cripple its nascent hydrogen sector.

Having planned to convert its natural-gas pipelines to transport hydrogen to future buyers in Europe, Russia is unlikely to be able to use this infrastructure for this purpose anymore. The EU will be an unlikely buyer of Russian hydrogen for the foreseeable future. Turning to Japan and South Korea would not be a success either, since they have joined the sanctions regime against Russia and, like the EU, have been officially labeled as unfriendly by Moscow. This will make the transfer of the technologies critical for the production of low- and zero-carbon hydrogen from the world leaders to a technologically backward Russia very problematic.

Europe will also feel long-lasting repercussions of Russia’s war in Ukraine in the energy and hydrogen sectors. With no steady supplies of cheap Russian gas or hydrogen, Europe’s decarbonization efforts and building up its hydrogen industry will be inhibited and require a lot more effort and money.

Russia will have to seek alternative markets for its energy commodities and it will seek deals with China, the only country whose energy consumption can rival that of Europe. But, as one of the world’s largest producers of electrolysers and of conventionally manufactured hydrogen, China probably will not need to import Russia’s hydrogen to build up its own hydrogen sector. Possessing critical technologies of its own, it will instead increase imports of Russian primary energy sources (such as natural gas) that it can use for producing hydrogen. The influx of huge volumes of cheap Russian feedstock will speed up China’s transformation from a country with a nascent hydrogen sector into a dominant player on the global hydrogen market.

If the EU or the United States—the only two actors comparable to China in economic, technological, and geopolitical strength—do not develop similarly strong hydrogen sectors, Beijing could end up dominating the global energy landscape. To avoid the geopolitical consequences of this and for global balance to be maintained, further cooperation between the EU and the United States will be needed to speed up the creation of strong hydrogen sectors for both.

Introduction

Hydrogen is the most abundant element in the universe, but it rarely exists in pure form; it has to be separated from other elements to be used. Although this separation—that is, industrial production—is not completely new, hydrogen’s popularity as energy carrier in the past was a lot less significant than that of fossil fuels. However, the current climate emergency and decarbonization attempts by the global community turn it into a very promising fuel that could make the road to a net-zero carbon future significantly shorter by replacing most of the hydrocarbons in use today. In particular, just like fossil fuels that are able to store and deliver energy, hydrogen could be utilized in diverse applications, such as heat and power generation, transport, and the production of various commodities generally associated with significant emissions (for example, fertilizers and steel).1

Hydrogen’s main difference from fossil fuels is that it does not emit carbon dioxide when incinerated or—perhaps even more important for sustainability—when produced through the process of electrolysis of water. In particular, electrolysis powered by renewable energy sources to generate “green” hydrogen is often described as the Holy Grail for a hydrogen economy.2 This is however still far from being reached by most producers, since green hydrogen currently costs several times more than conventionally manufactured hydrogen that uses fossil fuels as a feedstock.3

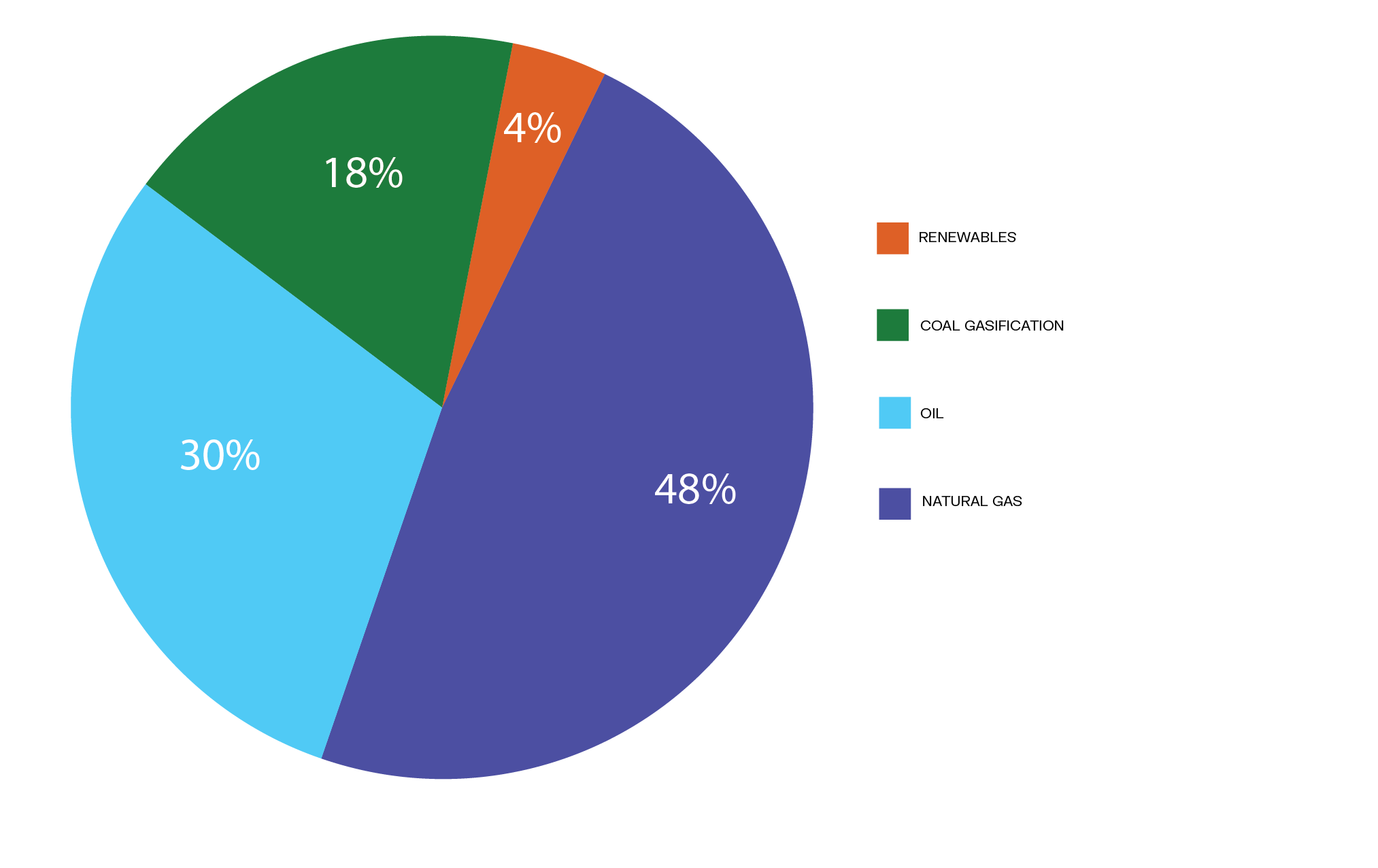

Hydrogen can be obtained as a by-product at chemical plants and refineries, or from heavy hydrocarbons unsuitable for catalytic steam reforming via partial oxidation.4 Today, the majority of hydrogen manufactured around the world is generated from fossil fuels, with natural gas as the primary feedstock.5 (See Figure 1.) Such hydrogen is commonly referred to as “grey” when its production does not involve carbon capture and storage (CCS)6 and “blue” when it does. If carbon dioxide from gas-based hydrogen generation involves the process of methane pyrolysis and thus transforms carbon dioxide into a solid substance (carbon black) that can then be used instead of being emitted into the atmosphere, the ultimate product of this process is called “turquoise” hydrogen. Finally, hydrogen produced from water via electrolysis and with the electricity involved coming from a nuclear power plant is usually defined as “pink.”7 (Medlock, 2021)

- 1Bellona, Hydrogen use in industry, 2020. Accessed September 5, 2022.

- 2Ken Medlock, A US perspective: the potential of hydrogen in its diversity, Oxford Energy Forum, May 2021.

- 3Ibid.

- 4US Energy Information Administration, Hydrogen for refineries is increasingly provided by industrial suppliers, January 2016.

- 5Patrick Molloy and LeeAnn Baronett, The truth about hydrogen, RMI, August 20, 2019.

- 6CCS normally involves the capture of carbon dioxide from the air or industrial processes, its delivery to the sequestration site and storage, usually underground in suitable geological formations (ibid).

- 7Medlock, A US perspective.

The Main “Colors” of Hydrogen

“Grey” – hydrogen produced from natural gas using steam methane reforming with no emission abatement mechanism involved.

“Blue” – hydrogen produced natural gas with carbon capture and storage (CCS) to minimize emissions.

“Turquoise” – hydrogen produced from natural gas by methane pyrolysis with solid carbon as a by-product. Similarly to CCS, this process of carbon capture and utilization to minimize carbon dioxide emissions.

“Green” – hydrogen generated via water electrolysis with power supplied from renewables and no direct carbon emissions.

“Pink” – hydrogen generated via water electrolysis with power provided by a nuclear power plant and no direct carbon emissions.

Note: Adapted from Ken Medlock, A US perspective: the potential of hydrogen in its diversity, Oxford Energy Forum, May 2021

Figure 1. Global Hydrogen Production by Main Source, 2018

Russia possesses the largest reserves of natural gas on the planet, a well-developed nuclear sector, suitable geological conditions for CCS, and significant potential for renewable energy production.9 Yet it lags behind the frontrunners in the race to build an hydrogen economy. Its first major hydrogen-related policy document—the 2020 Hydrogen Roadmap—was released only half a year after the European Union, Russia’s main energy trade partner, had approved its Hydrogen Strategy.10 Other potential importers of Russian hydrogen had published their national strategies or framework documents even before the EU: Japan in 2017, South Korea in 2019, and Germany and the Netherlands in the first half of 2020.11 It took Russia another year to release its “Concept on the development of hydrogen energy sector,” a document that still lacks the focus of a proper comprehensive strategy.12

Despite this apparently reactive approach to the development of its hydrogen sector, Russia was quite optimistic about the position it could take in this eventual global market, planning to account for up to 20 percent of it by 2030.13 Although it is still not clear how big this market will be, if its ambition were to be successfully realized, Russia could earn between $23 and $100 billion annually from hydrogen.14

Given that the hydrogen economy could dramatically reshape the international energy and economic landscape, the forced changes in Russia’s approach are likely to have a significant impact on the way the global hydrogen market will look in the coming years and decades.

To achieve these goals, Russia’s key energy companies started negotiating potential hydrogen supplies with their long-term business partners from some of hydrogen frontrunner countries even before the Hydrogen Concept was officially approved by the government.15 However, Russia’s invasion of Ukraine in February 2022 has dramatically changed its relations with most of the Western countries that used to be the largest consumers of its energy products. As a result, the approach of the government and businesses toward the development of the hydrogen industry has had to be altered. Given that the hydrogen economy could dramatically reshape the international energy and economic landscape, the forced changes in Russia’s approach are likely to have a significant impact on the way the global hydrogen market will look in the coming years and decades.

This paper tracks some of the most important adjustments that Russia has made in its hydrogen plans since the invasion of Ukraine. Looking at the sociopolitical and techno-economic aspects of its approach to the development of its hydrogen sector, the paper compares the country’s original approach to the one that it switched to after Western sanctions were imposed in response to the invasion of Ukraine. This helps to consider what role Russia could play in a global hydrogen market. The paper concludes by outlining potential implications of the changes in Russia’s plans for hydrogen exports for European and global energy security. In particular, it considers the effect that this could have for China’s hydrogen’s plans and the consequences for Europe and the United States.

Russia’s Prewar Ambitions

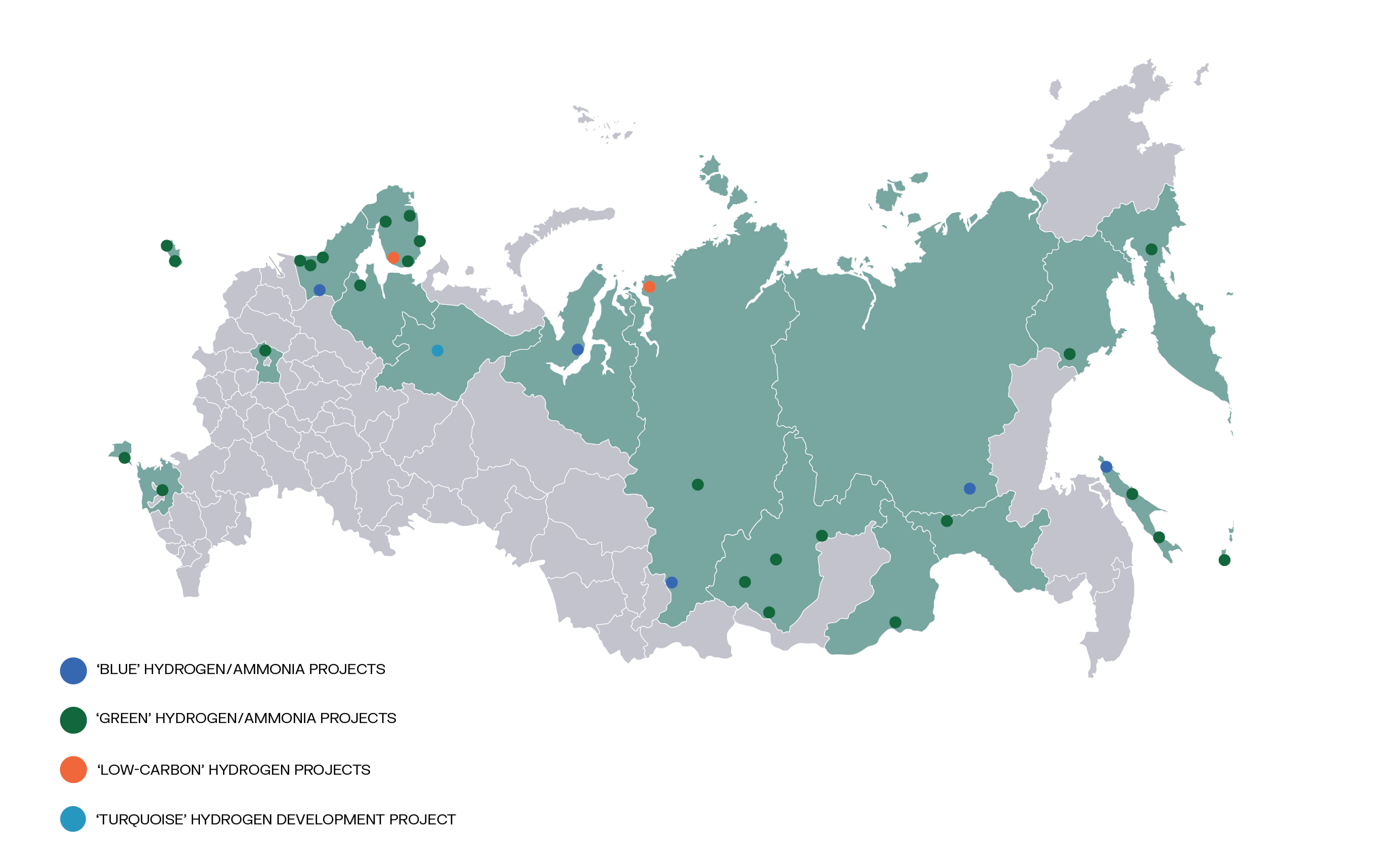

Originally designed as an export-oriented framework, Russia’s Hydrogen Concept of 2021 focused on two of the most promising future hydrogen markets—Asia and Europe. To explore the potential to supply hydrogen to both, the relevant ministries and energy companies developed draft projects that were later gathered in the “Atlas of the Russian projects on the production of ‘low-carbon’ and ‘carbon-free’ hydrogen and ammonia,”16 which was released at the end of 2021.17 As the world’s leading exporter of natural gas, Russia would have preferred to look at grey hydrogen as its first choice for the development of its hydrogen sector but it had to adjust its export options to the environmental requirements of the decarbonization agenda in Asia and Europe. As a result, the 33 projects for Russia’s 18 regions that were listed were supposed to generate only low-carbon or zero-carbon hydrogen and ammonia. (See Figure 2). Among these was one in illegally annexed Crimea.

Figure 2. Russia’s Planned Projects for Production of Low-carbon and “Carbon-free” Hydrogen and Ammonia

Apart from Gazprom and Novatek (Russia’s biggest state-owned and privately owned gas companies, respectively), the initial key stakeholders included Rosatom (the nuclear energy monopolist) and Lukoil (the largest private oil company). More recently, En+, a private company focusing on hydroelectric power generation, joined them.18 Judging by the list of the core actors, within the low-carbon and zero-carbon hydrogen domain, Russia’s focus was on its extensive expertise in the production of hydrocarbons, nuclear, and hydroelectric power. The most preferable types of hydrogen that Russia aimed to develop were blue, turquoise, green, and pink (generally represented as “low carbon” hydrogen projects in Figure 2). Although not clearly stated in the Hydrogen Concept, this was broadly expressed in the Hydrogen Roadmap of 2020.

Techno-economic Factors

Russia’s main competitive advantage in supplying energy products to external markets has rested on its extremely favorable geological conditions and the gradual development of an infrastructure dedicated to exporting. Because of the country’s unique natural endowment, natural gas became the key part of its energy exports. In general, extremely low cost of production coupled with government subsidies and pipelines—the least expensive delivery means for gas on land—made the Russian offer hard to beat. By comparison, Russian nuclear technologies and electricity export have been less important with other players with competitive offers present on the market.

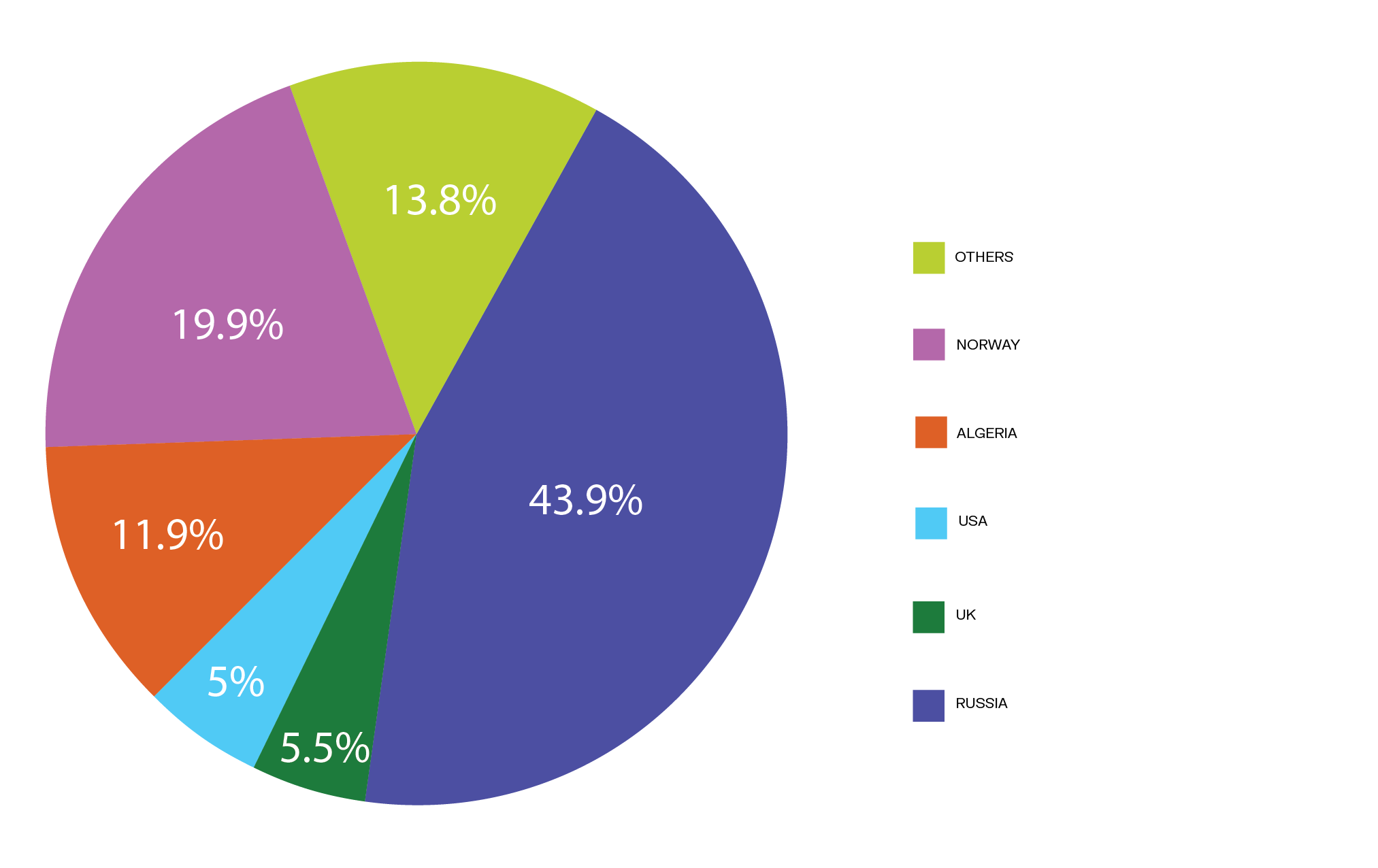

In its 2000 Green Paper titled “Toward a European strategy for the security of energy supply,” the European Commission warned about the EU’s dependency on a single energy provider and encouraged member states to diversify supplies, improve efficiency, and invest in renewable energy sources.19 Unfortunately, this advice was never closely followed. In the next two decades, Russia’s unbeatably low price offer as well as the volume of natural gas that it could rapidly export to the European market forced some of the leading EU members looking for a less polluting transition fuel to almost completely rely on the country. With the phasing out of coal and nuclear in Europe’s leading economies, such as in Germany after the Fukushima Daichi nuclear disaster in Japan in 2011, this dependency in fact grew to the extent that in 2020 almost half of the natural gas imported by the EU came from Russia. (See Figure 3.)

Figure 3. Sources of EU Imports of Natural Gas in 2020

Having made huge profits year after year from the EU, Russia’s state and private sector engaged in the energy field were surprised and concerned by the announcement of the European Green Deal in late 2019. The 2020 Russian Energy Strategy labeled as a challenge any reduction in the share of hydrocarbons in the energy mixes of Russia’s key EU markets that would be caused by their investment in sustainable technologies.20 Russia treated as a direct threat to its business and geopolitical ambitions the release of the EU Hydrogen Strategy that emphasized hydrogen as an alternative to hydrocarbons that could help to mitigate the deficiencies of intermittent renewable energy sources. By its nature, wind and solar energy production is intermittent while the electric grid needs to be balanced at all times. This creates a challenge since to-be-phased out fossil fuels are normally used to do so. Since hydrogen can be produced from water using renewable power, it is often viewed as an alternative to hydrocarbons for these purposes.

At the same time, while viewing the production of green hydrogen as the ultimate goal of its eventual hydrogen economy, the EU had to admit that “in the short and medium term […] other forms of low-carbon hydrogen are needed.”21 This was so primarily because of the significantly higher cost of green hydrogen in comparison to hydrogen of other colors as well as lack of sufficient capacity for its production at a scale that would be comparable with that of conventionally generated hydrogen (that is, produced from fossil fuels). As a result, the EU Hydrogen Strategy left a window of opportunity for Russia to adjust its energy exports to the changing nature of the EU market potentially with minimal costs and losses.

Given that, under normal conditions, steam methane reforming—the most common way to produce hydrogen—still is the cheapest technological process to generate hydrogen, natural-gas-based hydrogen is significantly more cost-competitive than other forms of hydrogen in most regions of the world. This holds true even when CCS technologies are used to sequester carbon dioxide emissions and make the ultimate product carbon-neutral, with blue hydrogen estimated to be two to three times less expensive than green hydrogen.22 In addition, given that natural-gas pipelines could be repurposed for the delivery of pure hydrogen or hydrogen-methane blend, gas-borne hydrogen could be transported faster and in much higher volumes than hydrogen of other colors without significant investment in new infrastructure.23 Both factors made the idea of building up a hydrogen sector primarily around its natural gas industry particularly promising for Russia.

Although Russia does not actively operate any large CCS projects, it has some of the best geological conditions for the development of this set of technologies.

Although Russia does not actively operate any large CCS projects, it has some of the best geological conditions for the development of this set of technologies. Since they normally involve injecting carbon dioxide into salt caverns or depleted gas reservoirs, certain regions of the country are among the most suitable places on earth for this. In addition, these geological formations are located close to gas production sites.24 Carbon dioxide can also be pumped into active reservoirs to enhance the production output.25

Companies like Gazprom have explored the process of methane pyrolysis that would allow for the generation of zero-carbon turquoise hydrogen,26 but the technology has not been commercialized yet. Therefore, the remaining options for Russia were nuclear-based pink hydrogen and renewables-based green hydrogen. Both, however, are marginal alternatives to gas-derived hydrogen as the capacity of even the biggest electrolysers—the key piece of equipment for generating hydrogen from water via electrolysis—is currently a lot less than the capacity of conventional hydrogen production plants. In addition, with only a few electrolyser generating facilities, Russia lags behind the EU, the world’s leader in this field, and China, the largest electrolyser manufacturer.27 To achieve a significant progress in the production of green and pink hydrogen, Russia would have to import electrolysers from one of them. Given that both are developing their own green hydrogen production and thus need every electrolyser unit available, rapid scaling up of this type of hydrogen production to a level comparable with the hydrocarbons-based one did not seem to be realistic to Russia. What is more, wind turbines and solar panels would have to be mostly imported too as Russia does not possess a major production facility of either that would be capable to completely cover its green hydrogen ambition.28

Even if large-scale generation of green hydrogen was attempted, it seems unlikely that Russian producers would be allowed to use the existing export pipeline infrastructure that is entirely owned by Gazprom, which is also interested in a share of the pie and would most probably not allow competitors to use its facilities.29 Thus, the Russian entities investing in low- and zero-carbon hydrogen other than blue hydrogen would have to convert hydrogen into ammonia since this would probably represent a more efficient means of delivery in the absence of pipeline delivery.30 This, however, would add to the overall cost and thus make such hydrogen even less attractive than gas-derived blue hydrogen.

Sociopolitical Factors

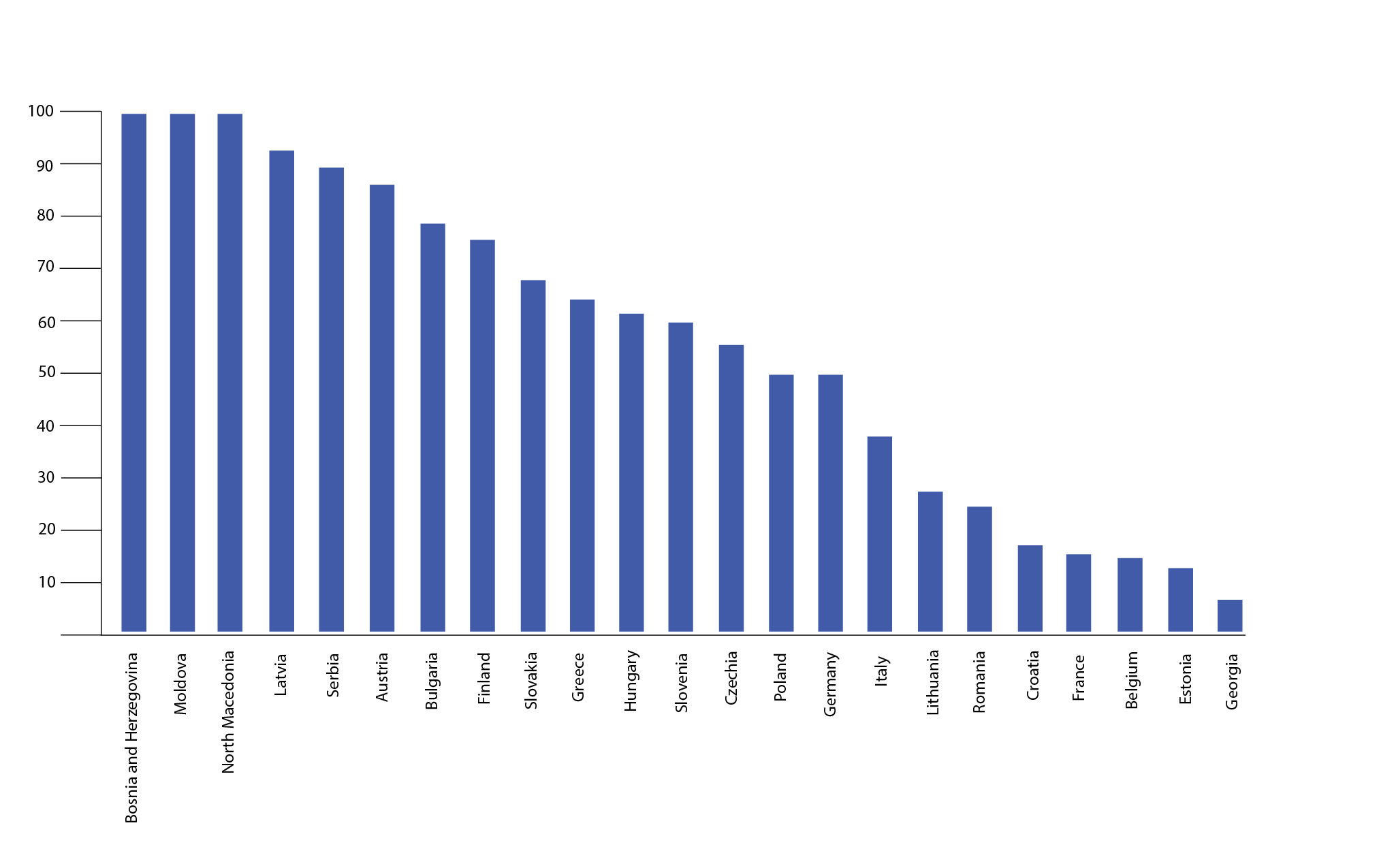

The sociopolitical environment before the invasion of Ukraine was generally favorable for the continued export of Russia’s energy products and the gradual realization of its hydrogen development plans. Despite the abundance of political statements in the EU urging greater diversification of energy imports, the country’s natural gas was far from being replaced with some other fuel. In fact, the situation was quite the opposite with many EU countries extremely dependent on Russian gas supplies and comfortable with this. (See Figure 4.)

Figure 4. Shares of Gas Supplies from Russia in Selected European countries, 2021

With the European Green Deal and Fit for 55 package nudging EU member states to invest heavily in renewables, natural gas from Russia appeared to be the most environmentally favorable transition fuel that could be used to balance the grid in periods when little or no energy could be generated through wind and solar power plants.31 The ongoing global energy crisis that started in 2021 demonstrated that, despite all the successful steps the EU had taken toward decarbonizing the economies of member states, green power is yet to become its main energy source, as a weather conditions in the first half of 2021 did not allow even decarbonization champions like Denmark and Germany to generate enough renewable electricity for their use.32 As a result, the EU had to use more gas to produce electricity and its storage capacities were only around 72 percent full by the time the price of gas skyrocketed in September 2021.33 In such conditions, the not particularly unified approaches of member states to buying Russian gas became even more divergent from the position of Brussels. Securing long-term supplies of gas from Russia at a discounted price seemed reasonable for quite a few member states.

For instance, seeing gas prices rising rapidly, in 2021 Hungary signed a 15-year supply contract for around 4.5 billion cubic meters from Russia each year until 2036 through transit routes in Austria and Serbia via the TurkStream pipeline.34 Hungary was not the only country preferring the reliable fuel of the past to the renewable but uncertain one of the future. Despite the opposition of several member states, most prominently Poland and the Baltic states (as well as of the United States), the Gazprom-initiated and -owned Nord Stream 2 pipeline that could be annually delivering 55 billion cubic meters of gas directly from Russia to Germany was technically completed in September 2021. Nord Stream 2 also created a basis for the future supply of Russian hydrogen as the new Gazprom pipelines are potentially suitable of transporting hydrogen in a blend with natural gas35 or potentially even in pure form.36 While the use of CCS is extremely politically contentious in Germany and some other EU members due to the opposition of local communities, societal acceptance Russia’s gas projects has historically been high. Thus, delivering Russia’s low-carbon hydrogen to Europe via existing pipelines was likely to face minimum opposition, which would further strengthen the country’s position as a future hydrogen supplier.37

In addition to low cost of production and well-established transportation routes to Europe, natural gas from Russia had strong backing within the EU’s political establishment. Germany’s persistent support for Nord Stream 2 left little doubt about the interest of Europe’s largest economy in the supply of Russian natural gas.38 The 2021 appointments of France’s former prime minister François Fillon as a board member of Russia’s largest petrochemical producer, Sibur, and Austria’s former foreign minister Karin Kneissl as a board member of the country’s oil giant Rosneft demonstrated the ability of the Russian energy sector to lobby for its interest at the highest political level in Europe.

Russia’s Ambitions Since the Invasion

Although Russia was quite late in expressing its hydrogen ambitions and launching related initiatives, by the start of 2022 it nonetheless had significant advantages compared to other countries planning to take a substantial share in the eventual hydrogen market, especially in Europe. These included a well-developed hydrocarbons sector and its infrastructure network, as well as historical expertise in nuclear energy and hydropower production. Russia also had some of the world’s best geological conditions for CCS and political support at the highest level in many European and non-European capitals. In principle, these advantages could have made Russia a dominant actor in the future global hydrogen economy.

Russia’s invasion of Ukraine has significantly damaged the country’s ambitions, however. This is not only because it has incurred the strongest economic sanctions in its history and now experiences complete political alienation from the West, but also because no mainstream European politician today would consider futures supplies of Russian hydrogen that would be as problematic as supplies of Russian gas. And, since Japan and South Korea—two countries that could become important hydrogen markets—have also sanctioned Russia,39 its potential Asian export vector is also in doubt.

Techno-economic Factors

Since the start of the war, some media reports in Russia have reflected more humble prognoses of the Ministry of Energy with respect to hydrogen. The country’s export ambitions have shrunk from an estimated 2.2 tons per year by 2030 to around 1.4 million.40 As a result of the war and the consequent loss of markets, Russia is now expected to lose at least half of its long-term hydrogen export potential, which would be around 4.5 million tons (Mt) per year by 2050 instead of exceeding 9.5 million Mt.41 This is due mostly to the fact that the world’s key consumers of the future—such as Japan, Germany, and South Korea—would not be importers of Russia’s hydrogen due to the sanctions regime.42

These estimates have been presented by the Energy Ministry as a part of a “Preliminary ‘stress scenario’ of the programme on the development of Russia’s low-carbon economy” in June 2022.43 Since there is no sign of an end to the war in the foreseeable future, these forecasts are likely to turn into a permanent reality. Given that the countries previously viewed as the main consumers of its hydrogen are now labeled by Russia as unfriendly and are ruled out from cooperation, it will have to reshape its hydrogen plans to cater instead to other countries (primarily in Asia) that are significantly less sure about the potential of this fuel for their future growth or appear to take a more pragmatic approach to making business deals with the Russian government.44 This reorientation will affect the technical side of the eventual Russian hydrogen sector as the country’s ambitions regarding blue and green hydrogen are likely to substantially suffer as a result.

Having expected to rely on its old and new natural gas infrastructure to supply hydrogen to Europe, Russia will likely no longer have such an option in the future. Given its war in Ukraine, the start of operations by Nord Stream 2—the gas transport infrastructure that would be most suitable for conversion to transport hydrogen—does not seem to be possible under any scenario. In fact, having been technically completed a few months before the war, it is now unused.45

Having expected to rely on its old and new natural gas infrastructure to supply hydrogen to Europe, Russia will likely no longer have such an option in the future.

These circumstances will create an urgent need for Russia to create completely and from scratch new facilities and networks for hydrogen storage and delivery to other destinations. While the profits expected are still estimated to be high (around $12.8 billion), the investment in production alone will need to be close to double that amount (at least $21.1 billion).46 The costs of the required follow-up construction of hydrogen infrastructure may be even higher. This means that, with most investors from rich countries that were previously considered to be main partners unlikely to fund this because of the sanctions, these undertakings will hardly be achievable.

With limited or no external funding, it is unlikely that Russian aspirations as to hydrogen shipping to Japan and South Korea, most probably via hydrogen conversion to ammonia, will be realized.47 With its relatively new liquefied natural gas (LNG) sector and only one company constructing appropriate carriers, Russia lags significantly behind when it comes to building marine carriers for such low- or zero-carbon fuels in large volumes.48 (By contrast, Japan has been actively engaged in designing hydrogen and ammonia carriers, and it has already received the first pilot deliveries of both fuels from Australia and Saudi Arabia, respectively.49 That is why, without technology transfer or the purchase of suitable vessels, Russia’s hydrogen export plans will have to be postponed until better times.

Delivery to the end user is not the only challenge that Russia’s eventual hydrogen industry is going to face under wartime circumstances. In particular, blue and green hydrogen production at the estimated quantities might become unrealistic. The primary reason for this is again technological backwardness—in CCS and electrolyser manufacturing—and reliance on foreign supplies. While the development of CCS could be conducted with the assistance of China, which would replace traditional leaders in the field such as Norway, scaling-up the generation of renewables-based hydrogen is less likely. This is because Europe is the world leader in the production of proton exchange membrane (PEM) electrolysers—a technology that is most suitable for being coupled with intermittent wind and solar power plants.50 While China has become one of the world’s leading manufacturers of alkaline electrolysers,51 this type of hydrogen production machinery is more suitable for power sources with stable load (for example, hydropower or nuclear power plants).52 As a result, even if Russia secures technological support from China, its options for the production of zero-carbon hydrogen will be significantly limited at least in the short- and medium-term.

There is also the question of whether China will be interested in establishing hydrogen-related cooperation with Russia. Although Russia has identified the country as its key potential hydrogen market, China has so far only announced one long-term plan related to hydrogen for 2021–2035.53 Determined to take a phased approach to developing its domestic hydrogen industry and to mastering technologies and manufacturing capabilities, China is quite conservative when it comes to targets.54 Its aim of generating 100,000 to 200,000 tons of green hydrogen annually by 2025 is dwarfed by the EU’s annual target of 1 Mt.55 Germany’s plan for a 14 terawatt-hours (TWh) production capacity by 2025 is more than twice as ambitious as China’s stated maximum goal of 6.7 TWh.56

Although the China Hydrogen Alliance has suggested that domestic demand would reach 35 Mt in 2030 and 60 in 2050,57 it is not clear how much hydrogen the country would have to import to meet it. Already the world’s largest producer of hydrogen with an output of around 33 Mt, China also mostly relies on relatively cheap, locally extracted fossil fuels as feedstocks for generation.58 Russia’s offer of a similar product—hydrocarbons-derived hydrogen—might not be significantly more attractive in terms of price as it will have to be delivered over long distances. The question will be about the quantity of hydrogen that China will need and whether any of that will have to be imported.

Russia’s offer of a similar product—hydrocarbons-derived hydrogen—might not be significantly more attractive in terms of price as it will have to be delivered over long distances.

To make its hydrogen more attractive to China, Russia will have to intensify the construction of energy infrastructure near their border. Extending the existing network of natural gas pipelines as well as launching new, potentially hydrogen/ammonia, ones would be a prerequisite for Russian exports. At the moment, however, Russia’s energy infrastructure that could deliver hydrogen and/or its derivatives to China is significantly less developed than the one directed at Europe. In contrast to the four large natural-gas pipelines that could have been converted to hydrogen transmission to Europe, the Power of Siberia one is the only one to Asia, and it has not managed to break even since its launch in 2019.59 In the current conditions of dramatically decreased state revenues, funding an even costlier undertaking with no clear prospects of success might not make sense.

Sociopolitical Factors

Being bound by long-term “take-or-pay” contracts,60 many European countries are still buying Russian natural gas, even if it has become clear that the Kremlin has long used this fuel as a political weapon by the Kremlin.61 At the same time, the invasion of Ukraine has made clear the necessity to urgently reduce the dominance of Russia’s gas with supplies from other countries until an eventual complete ban. Some countries, like Lithuania, have already stopped importing Russian natural gas and others, like Poland, have pledged to do so soon. While Germany and Italy—the biggest importers—are still finding it hard to do the same, they are taking decisive steps toward getting rid of their reliance on Russia. For instance, Germany has discussed alternative LNG shipments from Qatar and Italy is considering deliveries from Algeria. Although complete replacement will likely take several years, it is almost certain that no European country will any longer bind its economic development and decarbonization plans to a single supplier of critical fuel.

This has already been expressed in the European Commission’s plan to make the EU independent from Russian fossil fuels before 2030, known as REPowerEU.62 Although adopted in March 2022 in the wake of the invasion of Ukraine, its key steps for rapidly improving energy security are very similar to those in the European Commission’s Green Paper of 2000—save energy, produce more clean energy, and diversify supplies. However, REPowerEU sets more specific quantitative objectives, including some directly related to hydrogen. In particular, with the additional €200 million allocated under it for research in green hydrogen, the EU expects to generate 10 Mt of this zero-carbon fuel locally in addition to the import of 10 Mt by 2030. Given the aim of the document, none of the imported hydrogen will be from Russia.

While Japan and South Korea are still importing Russian LNG and, in contrast to the EU members, have not even been asked to pay for such transactions in rubles,63 their decision to join the sanctions regime against Russia automatically turned them into “unfriendly” nations in the eyes of the Kremlin. This resulted in both countries being excluded from the Energy Ministry’s “stress scenarios” as future hydrogen export markets. This leaves China has the only large potential consumer. At the same time, there has so far not been any decision on this in Beijing, which makes the possibility of this particularly unclear for Moscow.

This leaves China has the only large potential consumer. At the same time, there has so far not been any decision on this in Beijing, which makes the possibility of this particularly unclear for Moscow.

While large-scale imports of Russian gas could speed up the decarbonization of China’s economy and improve environmental and health conditions in the country,64 they could also provide feedstock for the intensified domestic production of Chinese hydrogen. Hydrogen, being significantly problematic and costly to store and transport65 will likely lose to natural gas in terms of cost and efficiency. In addition, in contrast to Russia, China views its hydrogen sector as initially oriented for domestic purposes. That is why, with the idea to build a fully-fledged sustainable hydrogen industry with all the relevant components such as research base, production, storage, and transportation network, China’s government is more likely to let in Russia’s raw materials (coal and gas) than its more complex rival commodities (green and blue hydrogen).66

With the intention to make green hydrogen constitute at least one-fifth of the energy consumed nationally by 2060, China’s government is more actively investing in building up the country’s competitive advantages in this field; for example, in alkaline electrolysers and solar panels.67 With the further spread of renewables as well as electrolysis technology and the consequent decrease in their cost, China is likely to ultimately switch to green hydrogen from hydrogen of other colors that would be associated with greater environmental impacts. This would be further bad news for Russia.

Conclusion

Russia’s current status as an energy superpower could be substantially reduced in the years to dome. While this primarily relates to the trend of decarbonization in the world’s leading economies, the phasing out of fossil fuels and their substitution with carbon-neutral alternatives is not the only factor that should be considered in this context. Russia was also aiming for a leading role among the key suppliers of hydrogen as the “fuel of the future” and the key replacement of hydrocarbons. However, its invasion of Ukraine and the sociopolitical and techno-economic consequences have jeopardized this ambition.

With the EU member states, Japan, and South Korea perceived as some of the largest hydrogen importers of the future, creating strong politico-economic ties with their public and private sectors would be crucial for the success of Russia’s hydrogen plans. This is because, in contrast to many other countries with strong hydrogen production potential that aim to develop their domestic hydrogen market first, Russia’s Hydrogen Concept is mostly export-oriented. Although some important steps to create links with eventual importers of hydrogen have been undertaken by the key Russian stakeholders of the hydrogen sector—such as Gazprom, Novatek, and Rosatom—all these efforts now look to have been in vain as each of these countries have introduced sanctions against Russia because of its war on Ukraine.

For Russia, this situation does not only mean losing some of the most lucrative bits of the future global hydrogen market. Given its technological inferiority in some of the sectors crucial for the generation of low- and zero-carbon hydrogen (such as renewable energy, electrolysers, and CCS), the loss of research and development cooperation, technology transfer, and foreign direct investment will also mean the substantially postponed or even halted development of Russia’s hydrogen industry. At the same time, since the rationale behind Russian energy projects is not always purely economic, the current international environment adversely impacting its hydrogen ambitions is unlikely to stop the Kremlin from striving for securing its energy influence in a future decarbonized world.

Implications for Europe

While Russia is the country whose emerging hydrogen sector is going to lose most from its war against Ukraine, Europe will also feel economic and decarbonization repercussions. Hydrogen—an integral part of the EU’s net-zero strategy—will substantially be affected. As its Hydrogen Strategy and the REPowerEU plan clearly state, the EU will have to import hydrogen as its internal production capacity is not likely to meet the expected capacity goals. Although today, due to the global energy crisis, rising gas prices across Europe have led to a fall in the cost of green hydrogen production compared with other colors of hydrogen, in the medium term green hydrogen will probably not be able to cover the entire volume needed as its production scale is much lower than that of hydrogen derived from fossil fuels.68 Without significant amounts of other forms of low-carbon hydrogen being in constant use on a permanent basis, Europe’s economies might not have enough impetus for the rapid development of their hydrogen infrastructure or sufficient demand for this fuel.69 In these circumstances, they will have to import decarbonized hydrogen from other countries where its production would be more expensive than in Russia.

Such an increased cost of hydrogen in use within its borders will slow decarbonization and inhibit the development of a well-functioning hydrogen economy in Europe. In order to become a widespread sustainable solution, for providing seasonal storage and backing up wind and solar energy, hydrogen will have to be comparable in terms of costs to hydrocarbons, the main fuels performing these functions at the moment. Expensive hydrogen that only a few European countries can afford will have no chance of replacing fossil fuels. This, in turn, would hamper the further spread of renewables as well as their grid integration since, in order to address their intermittency issue, countries will have to balance the grid by burning hydrocarbons, which obviously does not align with decarbonization objectives.

A delayed transition to hydrogen in Europe is likely to give other countries an opportunity to take a greater share of the eventual global hydrogen market. At the moment, Europe views hydrogen primarily through the prism of its decarbonization and is thus more likely to focus on domestic production and importing than on not exporting). And, while higher costs and lower quantities of hydrogen on the continent will make domestic businesses more reluctant to convert to it, countries in other regions where greater volumes of hydrogen circulation will be further stimulated by cheaper feedstock for its production will scale up their hydrogen sectors. China is the most obvious country to gain from the current state of affairs.

Global Implications

Due to geographic proximity and long historical connections, Russia has developed a relatively successful relationship with China. Having a similar authoritarian regime as well as growing ambitions for regional or global geopolitical dominance, China has recently been tolerant of Russia’s military aggression and attempts to change the global status quo. The current international isolation of Russia as result of its war on Ukraine is likely to make their ties even stronger for some time.

This will have implications for the global hydrogen industry. Although China is not likely to sacrifice the development of its hydrogen sector for the sake of cheaper Russian imports, Russia has a strong chance to speed up China’s development into a hydrogen superpower by providing cheap feedstock for Chinese hydrogen generation. This scenario is very realistic, especially given that the EU—to date Russia’s key energy market—has clearly signaled its intention to reduce its imports of Russian energy products to the absolute minimum. In these conditions, it would be in Russia’s interest to redirect its energy exports to where their markets will be secured for a long time, with China for now appearing the only such destination with a market of comparable scale to the European one.

With roughly a quarter of the volume globally generated, at about 25 Mt, China already is the largest manufacturer of hydrogen.70 Since most of this volume is produced from fossil fuels (roughly 60 percent from coal and 25 percent from natural gas),71 imports from Russia could allow China to further extend its generation capacity and simultaneously focus on green hydrogen production. Alternatively, by importing more Russian natural gas (for example, through the planned Power of Siberia 2 pipeline), China could phase out coal. As a result, by developing hydrogen of different colors and thus creating a sounder hydrogen infrastructure, it would not only be able to develop a sound domestic hydrogen sector but also to create the basis for the further export of this fuel to other countries.

In the long term, the transformation of China from a country with a nascent hydrogen sector into a dominant player on the global market will change the power balance not only in the Asia-Pacific but in the world. If neither the EU nor the United States—the only two actors comparable in economic and geopolitical strength—have similarly strong hydrogen industries to rebalance the situation, the world could end up with one country dominating the entire energy landscape. With China’s geopolitical ambitions and territorial claims, such a situation might be an enabler for several unfavorable conflict scenarios. That is one further reason why further cooperation between Europe and the United States is needed to speed up the creation of strong hydrogen sectors in both.

- 9NS Energy, Profiling the top five countries with the biggest natural gas reserves, March 2021.

- 10Ministry of Energy of the Russian Federation, План мероприятий («дорожная карта») по развитию водородной энергетики в Российской Федерации до 2024 года, [The plan of activities (“roadmap”) on the development of hydrogen energy sector in the Russian Federation until 2024] November 2020; European Commission, A hydrogen strategy for a climate-neutral Europe, July 2020.

- 11Martin Lambert, EU Hydrogen Strategy. A case for urgent action towards implementation, Oxford Institute for Energy Studies, July 2020.

- 12Government of Russia, Энергетическая стратегия Российской Федерации на период до 2035 года, [Energy strategy of the Russian Federation until 2035] June 2020.

- 13Vesti, Водородные перспективы России: 20 процентов мирового рынка, June 2021. [Russia’s hydrogen prospects: 20 percent of the world’s market]

- 14Ibid.

- 15Centre for Eastern Studies (OSW), A hydrogen alliance? The potential for German-Russian cooperation in hydrogen energy, March 2021.

- 16Given that transportation is challenging due to hydrogen’s physical properties (liquefaction requires cryogenic temperatures of -253 oC), the hydrogen derivative ammonia is often viewed as one of the most suitable form in which to transport it.

- 17Minpromtorg, Атлас российских проектов по производству низкоуглеродного и безуглеродного водорода и аммиака, [Atlas of the Russian projects on the production of low- and zero-carbon hydrogen and ammonia] October 2021.

- 18Ibid.

- 19European Commission, Green paper—Toward a European strategy for the security of energy supply, November 2000.

- 20Government of Russia, Энергетическая стратегия Российской Федерации на период до 2035 года. [Energy strategy of the Russian Federation until 2035]

- 21European Commission, A hydrogen strategy for a climate-neutral Europe.

- 22International Renewable Energy Agency, Green hydrogen cost reduction. Scaling up electrolysers to meet the 1.5oC climate goal, December 2020.

- 23EU Agency for the Cooperation of Energy Regulators, Repurposing existing gas infrastructure to pure hydrogen: ACER finds divergent visions of the future, July 2021.

- 24Ebergy Policy, Economising on decarbonization, October 2021.

- 25RPS Group, Technical considerations for subsurface storage to support the energy transition, October 2017.

- 26Montel News, Turquoise hydrogen cheaper, more efficient than green—Gazprom, September 2021.

- 27Davine Janssen, “Europe, China battle for global supremacy on electrolyser manufacturing,” Euractiv, August 2020.

- 28Mario Pagliaro, “Renewable energy in Russia: A critical perspective,” Energy Science & Engineering, July 2021.

- 29Reuters, “Gazprom monopoly on pipeline gas exports “unshakeable’—Putin aide,” July 2014.

- 30Aliaksei Patonia and Rahmatallah Poudineh, Ammonia as a storage solution for future decarbonized energy systems, Oxford Institute for Energy Studies, November 2020.

- 31Clean Energy Wire, “‘Dark doldrums’ highlight supply challenges for Germany’s fossil power phase-out,” February 2021.

- 32Aliaksei Patonia, “Why did gas prices suddenly spike,” EU Observer, October 2021.

- 33Ibid.

- 34Bloomberg, “Four European gas buyers made Ruble payments to Russia,” April 2022.

- 35For Nord Stream 2, the possible concentration of hydrogen within the blend is estimated to be as high as 70 or even 80 percent. Gazprom, Pure hydrogen from natural gas, November 2020.

- 36Ibid.

- 37Politico, “Why Merkel chose Russia over US on Nord Stream 2,” July 2021.

- 38OSW, A hydrogen alliance?

- 39Voice of America, “South Korea to join Russia sanctions, but won’t lodge its own,” February 2022.

- 40Digital Energy, Минэнерго ухудшило прогноз по экспорту водороды из РФ в своем проекте комплексной программы развития водородной энергетики до 2030 года, [The Russia’s Energy Ministry worsened expectations on the export of hydrogen in its draft of the complex programme on the development of hydrogen energy sector until 2030] June 2022.

- 41Ibid.

- 42Kommersant, “Водород уже не тот,” [Hydrogen is not the same anymore] June 2022.

- 43Digital Energy, Минэнерго ухудшило прогноз по экспорту водороды из РФ в своем проекте комплексной программы развития водородной энергетики до 2030 года, [The Russia’s Energy Ministry worsened expectations on the export of hydrogen in its draft of the complex programme on the development of hydrogen energy sector until 2030]

- 44Ibid.

- 45CNBC, “Nord Stream 2 cost $11 billion to build. Now, the Russia-Europe gas pipeline is unused and abandoned,” March 2022.

- 46Kommersant, Водород уже не тот. [Hydrogen is not the same anymore]

- 47Aliaksei Patonia and Rahmatallah Poudineh, Global trade of hydrogen: what is the best way to transfer hydrogen over long distances?, Oxford Institute for Energy Studies, August 2022.

- 48Ship Technologies, Arc7 ice-class LNG tankers, Russia, April 2022.

- 49Bloomberg, “Four European gas buyers made Ruble payments to Russia,” April 2022 and Offshore Energy, “HySTRA marks completion of world’s 1st Lhydrogen carrier voyage,” April 2022.

- 50Aliaksei Patonia and Rahmatallah Poudineh, Cost-competitive green hydrogen: how to lower the cost of electrolysers?, Oxford Institute for Energy Studies, January 2022.

- 51S&P Global, China scaling up electrolyzer manufacturing base for domestic, export markets, January 2021.

- 52Patonia and Poudineh, Cost-competitive green hydrogen.

- 53Xinhua, “China maps 2021-2035 plan on hydrogen energy development,” March 2022.

- 54Center for Strategic and International Studies (CSIS), China unveils its first long-term hydrogen plan, March 2022.

- 55Mercator Institute for China Studies, China’s nascent green hydrogen sector: How policy, research and business are forging a new industry, June 2022.

- 56Ibid.

- 57CSIS, China unveils its first long-term hydrogen plan.

- 58Ibid.

- 59Although Russia has reportedly invested $55 billion into its pipeline deal with China, its natural gas exports to the country through the Power of Siberia pipeline have only totaled $3.81 billion since December 2019. CNBC, “Nord Stream 2 cost $11 billion to build.”

- 60A take-or-pay clause in a long-term LNG or gas contract typically obligates the buyer of LNG or gas to take and pay for such LNG or gas, or otherwise pay an agreed price on a heat-content or volumetric basis for any LNG or gas not taken.

- 61Bloomberg, “https://www.bloomberg.com/news/articles/2022-04-27/four-european-gas-buyers-made-ruble-payments-to-russia;Four European gas buyers made Ruble payments to Russia.”

- 62European Commission,REPowerEU: affordable, secure and sustainable energy for Europe, March 2022.

- 63Reuters, “Japan, South Korea buyers have not yet been asked to pay roubles for Russian LNG imports,” July 2022.

- 64Energy Monitor, “China could decarbonise faster with cheaper Russian gas,” March 2022.

- 65Patonia and Poudineh, Global trade of hydrogen.

- 66Clean Technica, https://cleantechnica.com/2022/03/24/chinas-green-hydrogen-message-spells-bad-news-for-russia/;China’s green hydrogen message spells bad news for Russia, March 2022.

- 67Ibid.

- 68Energy Monitor, “Green hydrogen cheaper to produce than both blue and grey in Europe,” November 2021.

- 69Ralf Dickel, Blue hydrogen as an enabler of geen hydrogen: the case of Germany, Oxford Institute for Energy Studies, May 2020.

- 70CSIS, China unveils its first long-term hydrogen plan.

- 71Ibid.

Appendix

Expand AllAbout the Author

Aliaksei (Alex) Patonia is a research fellow in commercial hydrogen development at the Oxford Institute for Energy Studies and a fellow at the Institute for Advanced Sustainability Studies of Potsdam. He mainly explores the potential use of hydrogen and its derivatives in future decarbonized energy systems. His articles have appeared, among others, in the Diplomat, EU Observer, Geopolitical Monitor, Natural Gas World, Apolitical, and Petroleum Review of the Energy Institute. Alex holds Master’s degrees in energy management, sustainable development, and public policy from the Universities of Liverpool, St. Andrews, and Oxford.