Alliances in a Shifting Global Order: Brazil

Brazil: A Voice for All?

by WILLIAM MCILHENNY.

Read the full report here.

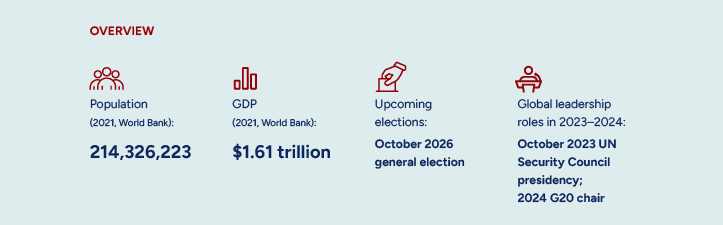

“Brazil is back,” says President Luis Ignácio Lula da Silva in reference to the quest for the influence and respect accorded a first-rank global player. Brazil has strengths that support such status but securing it requires pragmatic statesmanship, domestically and internationally, also of the first rank.

The country sees itself as an adroit hedger that protects its interests by avoiding taking sides. It seeks the revision of global architecture to favor inclusiveness, more regional integration, and greater engagement with a broad spectrum of countries with little need for ideological litmus tests, including one for democracy.

Brazil advocates robust partnerships to help address the world’s biggest problems, particularly global climate change and deforestation, food security, and inequality. This approach dovetails with, and may be key to, Lula’s most daunting domestic priorities. It may also encourage pragmatic partnership preferences and choices for an internally polarized country, although the incumbent foreign policy leadership favors greater strategic distance from the big Western powers. For the United States and Europe—no less than for Brazil—the situation demands a willingness to be patient and accept compartmentalized engagement on these issues.

Brazil’s substantial assets confer leverage. Its size; sophisticated human and technological capital and productive capacity; economic importance; regional military strength; vast agricultural, mineral, and energy production; enormous potential to fight climate change; sophisticated diplomatic apparatus; and a resilient, if stressed, democracy cumulatively underscore the country’s capacity to help address global priorities.

Brazil seeks to deepen its engagement on trade, investment, security, and technology issues with players as diverse as China, the EU and its member states, the United States, Russia, and India through “strategic” (as Brazil describes it) alliances and partnerships of varying depth and impact. Brazil rejects that its choice of partners must be mutually exclusive. At the same time, it realizes that other countries’ inclinations toward conditionality can impose opportunity costs and that its interests may require hard choices that will disappoint some partners. In this regard, Brazil epitomizes the characterization of the Global South laid out previously in this report.

Playing It Safe

Brazilian logic on security policy, especially concerning Ukraine, exemplifies the disappointment partners may feel. Loath to choose sides after Russia’s invasion, Brazil reluctantly voted for the initial UN Security Council resolution condemning the Kremlin’s move but declined to support sanctions. Despite Brazil’s large ammunition exports, Lula rebuffed entreaties from US and German leaders to sell some to Ukraine. Yet Brazil was the lone BRICS state to vote for the February 2023 UN General Assembly resolution demanding a Russian withdrawal. Brasilia seeks to position itself as a peace broker, although Western governments doubt its impartiality as it seems to seek common cause with China.

Brazil has had preferred military ties to the United States and Europe (notably France), also its leading import and export partners. But its major non-NATO ally (MNNA) status has not precluded other, if less substantial, military agreements, exchanges, and training exercises with many nations, including China and Russia.

Open for Business

Brazil, the world’s 12th-largest economy, is a top trade player with enormous production and exports of iron ore, soybeans, and beef, and major exports of commercial aircraft and other high value-added goods. Traditionally skeptical of free trade agreements (but possibly on the cusp of ratifying a highly significant, long-gestating pact between the EU and the Southern Common Market (MERCOSUL)), Brazil retains substantial tariff and nontariff trade barriers.

China is Brazil’s top trade partner, followed by the EU and the United States, but the $100 billion relationship with the United States is the most diversified of the three. Brazil seeks to upgrade its Chinese trade links and make them similarly wide-ranging. They are now profoundly lopsided toward raw material exports.

The United States leads foreign and direct investment in Brazil, according to the country’s central bank. The $128 billion that Americans have poured in exceeds that of even the EU. China has invested more than $66 billion since 2010, especially in infrastructure, and has become a critical pillar of Brazilian economic growth. Brazil welcomes this development, as it assiduously seeks increased investment, including from Russia (in energy). The regulatory environment for investment has long tacked more liberal than for trade, even if accompanied by a host of sectoral restrictions, such as those involving rural land.

Russia continues to be a major source of Brazilian agriculture’s vital fertilizer imports, supplying about a quarter of them. Trade links in other sectors, however, have suffered. Brazil may not have joined in moves to isolate the Kremlin, but the country’s large multinational firms, such as aviation giant Embraer, generally moved quickly to withdraw from Russia following the imposition of US and EU sanctions.

Regarding multilateral institutions, Brazil’s profile was growing in the World Trade Organization (WTO), where it had sought to forgo special and differential treatment and supported EU efforts to create a working group on reform. Lula’s accession to power, however, leaves unclear the tenor of Brazil’s future engagement there, and of its previous interest in membership in the Organization for Economic Co-operation and Development. This may be one sign of a more revisionist Brazil that seeks to dilute Western influence and strengthen alternative global structures.

China Calling

US and European government and industry are valued partners in technology infrastructure, particularly for military and security purposes. Brazil’s information and communication technology market is among the world’s 10 largest, valued at more than $50 billion, and it is growing as Lula pledges that his government will spur a digital industry revolution.

US and European technology and science cooperation is anchored in bilateral agreements, some of which are highly specialized and facilitate important technology transfer and commercial partnerships. Meanwhile, China has an increasing role guiding growth in Brazil’s technology sector. Beijing is accelerating investment in key sectors such as renewables and telecommunications. Chinese companies have benefited from Brazil’s resistance to US pressure to exclude them from 5G infrastructure development, though government-issued personal communication devices are an exception. Brazil has a mature telecommunications policy and regulatory environment but generally does not share US security concerns about China’s role. At the same time, China’s cutting-edge technology and pricing advantages significantly bolster its companies’ competitiveness, despite growing concern over Chinese influence and its impact on Brazilian manufacturing.

In the aerospace sector, Brazil is already a standout, producing and launching satellites, and developing launch vehicles through various forms of cooperation with Russia, China, the EU, France, and Germany. Brazil also benefits from agreements and significant collaboration with the United States to start commercial space launches from the Alcântara Space Center, an area in which Brazil is especially keen for greater investment. Three of the five foreign companies approved to operate at the center are based in the United States. Brazil signed in 2021 additional agreements with space agencies of other BRICS countries for joint development of a remote-sensing satellite constellation.

The Power Game

Brazil defends a rules-based global order but continues to view traditional arrangements as skewed in favor of traditional powers, notably the United States. Brazil seeks to temper this by supporting new organizations and processes that transfer influence from Western to emerging powers. It believes closer alignment to China will advance this goal. In the meantime, Brazil works with other G4 nations on UN Security Council reform while seeking its own permanent seat. And its 2024 G20 presidency will test its capacity to bridge the interests of major powers and the transformational aspirations of the Global South. Brazil seeks to revive and strengthen the India Brazil South Africa (IBSA) Forum and the position of the BRICS and use them as tools to revise global governance. To expand its influence in finance and development matters, Brazil, as a founding member, is active in the Beijing-based Asian Infrastructure Investment Bank. It also plays a key role in the Shanghai-based New Development Bank. In March 2023, Lula secured the resignation of that institution’s Brazilian president and replaced him with a loyalist countrywoman, former President Dilma Rousseff.

In regional governance Brazil seeks to strengthen organizations and associations such as Community of Latin American and Caribbean States, MERCOSUL, and the Union of South American Nations (or UNASUR, which it just rejoined). Brazil believes that these groupings can help advance its own leadership and Latin American integration while reducing US influence in the region.

Read the full report here.