US Energy Policy After the 2024 Elections

Cooperation on energy and climate policy, however, hovers near the top of the list of issues that could face disruption. Amid significant changes in global energy markets and geopolitical dynamics, Europeans should brace themselves for possible major shifts in US policy.

Donald Trump’s return to the White House would bring back rhetoric of US “energy dominance”, withdrawal (again) from the Paris Climate Agreement, and an effort to gut clean energy laws and regulations promulgated during the Biden administration. Energy exports would be promoted, and US trading partners would again be under pressure to buy them to reduce Washington’s trade deficit. Indeed, most US energy policies in a second Trump administration would mirror those of the first.

Still, much clean energy legislation passed under Biden, including investment tax credits for renewables and tax credits for clean hydrogen, would be difficult to reverse. But a Trump 2.0 could amend regulations governing some clean energy provisions introduced by the Inflation Reduction Act and Biden’s executive actions (e.g., on curbing methane leakage). And the implementation of laws and regulations not undone easily could proceed slowly or simply be neglected and forgotten.

Smooth sailing with this strategy would not be guaranteed. Efforts to frustrate a new Trump administration’s efforts to undo Biden’s climate legacy could arise on the subnational level. Most spending on clean energy supply chains occurs in states where Republicans are in control, and those states are likely to seek to limit efforts to curb that largesse. Other states, Democratic California likely among them, will also work to keep climate action alive. And courts are likely to restrict efforts at a wholesale dismantling of climate policies, as they did during Trump’s first stint in the White House.

A second Biden administration, on the other hand, would almost certainly focus on implementing the laws, and spending the available funds, from the legislation passed in the previous four years. And if the Democrats control Congress, they could well pass additional climate-related legislation, such as measures to facilitate the construction of transmission lines. Major energy and climate legislation, like that passed during Biden’s first term, however, would be unlikely.

The Transatlantic Impact

A new Trump administration would quickly end the current “pause” on new US liquefied natural gas (LNG) export authorizations for countries lacking a free trade agreement with the United States. Pending export authorizations would be approved soon thereafter. A second Biden presidency would likely also move in this direction, albeit, perhaps, with export authorization conditions that further reduce greenhouse gas emissions from LNG terminals. This could include requiring the use of electric motors or carbon capture technology. But a reelected Biden may feel the need to deny one or more export permits to satisfy environmental activists.

Next year’s White House resident will not impact LNG supplies. Ample American LNG will be available to satisfy European demand through 2030 since seven operating US export terminals and an additional five under construction will remain unaffected by the presidential election result. Whether US supply will continue to grow, however, is unclear.

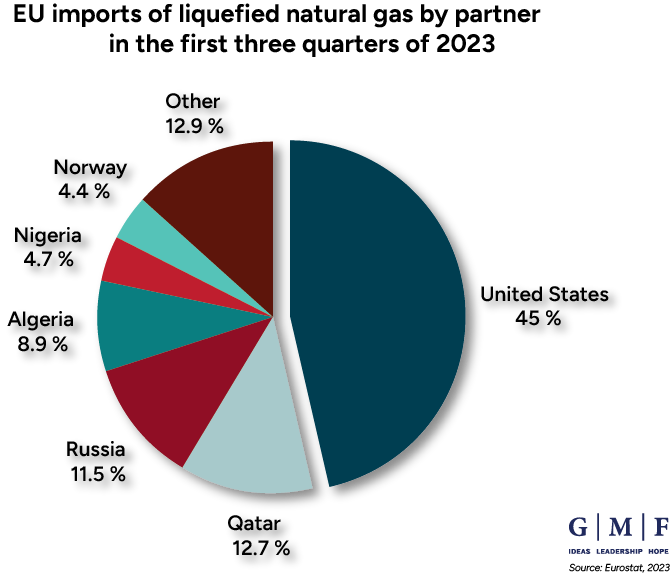

Europe’s increasing reliance on US energy supplies, which have played a pivotal role in ensuring EU energy security as the war in Ukraine rages, should prompt Brussels to look at further diversifying its supply chains. Europeans are becoming increasingly anxious about the prospect of a Republican presidency, fueled by memories of the turbulent Trump era. But a second Biden administration could yield to political pressure and restrict energy exports. In either case, Europe should seek greater strategic sovereignty and alternative partnerships for natural gas and other energy sources even if the United States will remain an essential supplier.

The upshot is that the transatlantic trade agenda on energy will be tense regardless of the US presidential election winner. A second Biden administration may say it wants to work closely with Europe on the energy transition, but protectionist impulses will persist.

Trump sees Europe as only slightly less bad than China on trade matters, and EU implementation of its Carbon Border Adjustment Mechanism (CBAM) will only exacerbate tensions in this area. Trump will not be interested in cooperating with the bloc on a trade-related climate agenda, but the United States and Europe could work together on a CBAM-like effort to target China. After all, some bipartisan support in the US Congress for a “foreign pollution fee”, which has China in its sights, already exists. The next US administration, whether Biden’s or Trump’s, could find collaboration with the EU on incentivizing China to reduce emissions appealing, especially if the bloc were open to adjusting the CBAM. Biden may see that strategy as good climate policy; Trump would likely see it as punishing China for alleged unfair trade practices. Either way, the consequences would be the same. In this vein, the US-EU cooperation on critical raw materials begun under the current administration could provide another area for a unified transatlantic approach to China—even if Trump returns to power.